Importers

You can be a True Source Honey Importer if you purchase honey from an Exporter and you are responsible for:

- ensuring the imported honey comply with local laws and regulations,

- filing a completed duty entry and associated documents, and

- paying the assessed import duties and other taxes on honey and then selling the honey to a North American Packer.

Participating Importers are not audited - they facilitate the trade between True Source Certified Exporters and Packers according to True Source Certified Standards.

Follow the instructions below to participate:

- Understand the phased implementation of requirements. In order to allow time for Packers and Importers to prepare their suppliers for the requirements of True Source certification, a phase-in period has been established that applies to the percentage of loads purchased by the Packer.

- Purchase honey from approved countries.

- Provide required documentation to the Packer for every shipment of raw honey. All documents must identify loads using the True Source ID number for high and medium risk countries, as well as for all fully compliant loads (minimally compliant loads do not require the use of the True Source ID number).

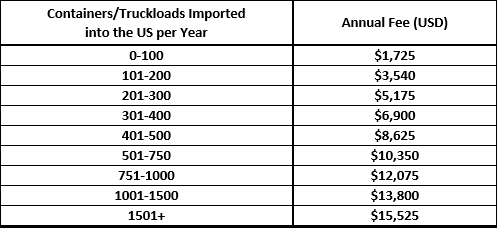

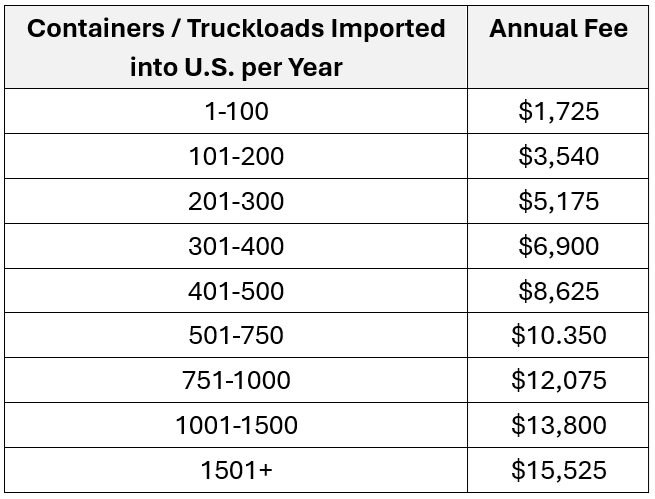

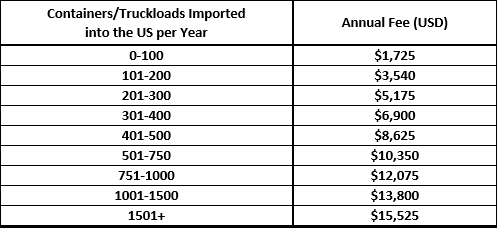

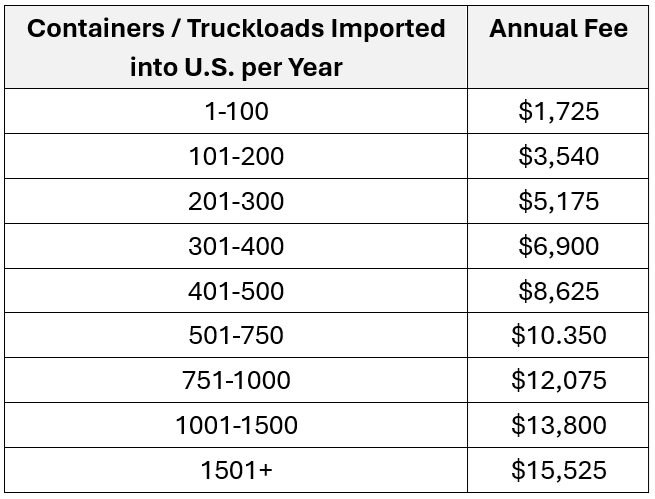

- Complete an Importer registration form and submit the annual fee. True Source Honey requires payment of an annual fee based on the total number of True Source containers/truckloads imported into the United States per year. The current fees are below:

Please note: registering as an Importer is registering as a True Source Honey participant. Importers are not considered True Source Certified, as they are not subject to the certified audit as administered by third-party auditors.

|