Processors/Exporters

You can be a True Source Certified Processor/Exporter if you are a company located outside the United States operating within an approved country that operates a bulk plant/factory handling honey only from your country of operation.

Follow the instructions below to participate:

- Maintain a system of traceability. Clearly identify all shipments of honey that arrive to or are shipped from the plant. Maintain the identity of individual lots of raw honey from specific suppliers as honey is processed to create product for export, retail, wholesale, or bulk ingredient market.

- Provide required documentation to the Importer or Packer for every shipment of raw honey. All documents must identify loads using the True Source ID number for high and medium risk countries, as well as for all fully compliant loads (minimally compliant loads do not require the use of the True Source ID number).

- Clearly label all individual drums. Each drum sold to an Importer or Packer must include the name and address of the Exporter, Exporter lot number/s, and for fully compliant loads, the True Source Certified ID number.

- Apply a True Source Certified tamper evident seal to ocean container loads. Each fully compliant load must have a True Source Certified tamper evident seal applied to the ocean container. The seal will be supplied by the third-part audit firm and assigned to the Exporter.

- Successfully complete audit by third-party audit firm.

- Facility Audit: Verification of traceability system and documentation requirements for purchased loads. Verification of kgs purchased against kgs sold.

- Sample Collection: The audit firm will collect random samples of honey inventory to compare against stated origin (pollen).

- Suppliers (Beekeepers) will be selected at random to participate in phone and field audits to confirm stated volumes of trade.

- When you are ready to become a True Source Certified Exporter, contact Intertek at [email protected] to get the audit and certification process started.

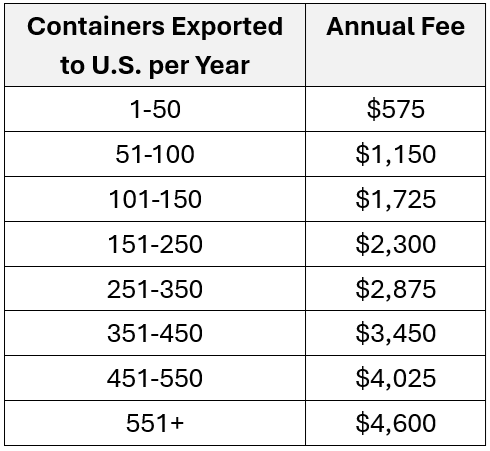

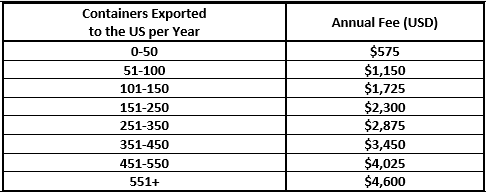

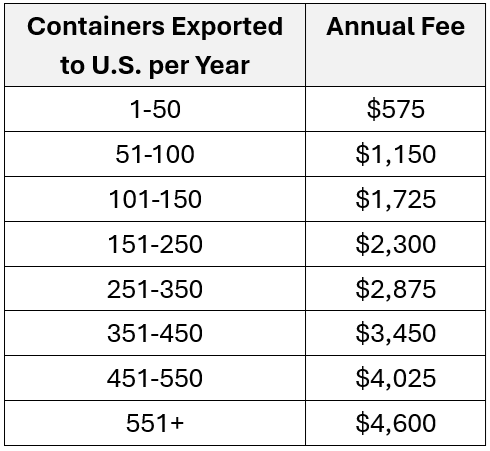

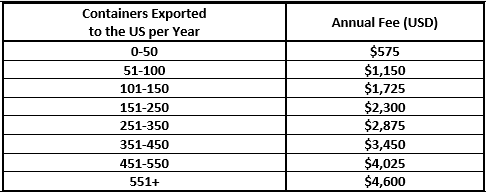

- Submit the annual fee to True Source Honey. Upon completion of the third-party audit and certification process, True Source Honey requires payment of an annual fee based on the total number of True Source containers exported to the United States per year. The current fees are below:

Please note: the TSH annual fee is separate from fees paid to third-party auditors for the annual audit that is carried out for all Exporters to ensure that the True Source Certified Standards are met.

|